stock option sale tax calculator

And if you re-purchase the stock. All thats necessary to calculate the value of startup stock options is A the number of shares in the.

Those shares could be worth 10 per share or 1000 per share.

. Youre basing your investing strategy not on long-term considerations and diversification but on a short-term tax cut. Ad Between 930 and 1045 EST there is a trade that could help you retire early. How much are your stock options worth.

Just follow the 5 easy steps below. This permalink creates a unique url for this online calculator with your saved information. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

16000 - 15000 1000 taxable income. Ad Fidelity Has the Tools Education Experience To Enhance Your Business. 3 thoughts on Free Stock Options Calculator-Easily Analyze All 4 Options Contracts With The Best Options Calculator YP Investors March 2 2021 at 812 am.

NSO Tax Occasion 1 - At Exercise. Ordinary income tax and capital gains tax. 100 shares x 150 award priceshare 15000.

You paid 10 per share the exercise price which is reported in box 3 of Form 3921. The following table shows an example of how much stock option values would be at various growth levels for an employee who annually obtained 1000 stock option grants at a strike. In our continuing example your theoretical gain is.

The Stock Calculator is very simple to use. Poor Mans Covered Call calculator addedPMCC Calculator. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Please enter your option information below to see your potential savings. 60 of the gain or loss is taxed at the long-term capital tax rates. Not Reporting Stock Sales On Form 8949Schedule D.

That form should show 4490 as your proceeds from the sale. 40 of the gain or loss is taxed at the short-term capital tax. Ad Looking for stock options tax calculator.

The Stock Option Plan specifies the total number of shares in the option pool. Exercising your non-qualified stock options triggers a tax. Cash Secured Put calculator addedCSP Calculator.

Your basis in the stock depends on the type of plan that granted your stock option. Ad Fidelity Has the Tools Education Experience To Enhance Your Business. Content updated daily for stock options tax calculator.

This calculator illustrates the tax benefits of exercising your stock options before IPO. Enter the purchase price per share the selling price per share. This trading window opens most mornings and can be your most profitable hour.

Click to follow the link and save it to your Favorites so. Back to Calculators Talk to sales 800-225-5237 Start. There are two types of taxes you need to keep in mind when exercising options.

Regarding how to how to calculate cost basis for stock sale you calculate cost basis using the. Use the employee stock option calculator to estimate the after-tax value of non-qualified stock options before cashing them in. Taxes for Non-Qualified Stock Options.

After you sell stock during the tax year you must complete IRS Form 8949 when adjustments are needed. Capital Gains Tax Calculator. Section 1256 options are always taxed as follows.

Subtracting your sales price 4490 from your cost basis 4500 you get a loss of 10. When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a share. Find the best spreads and short options Our Option Finder tool.

Enter the number of shares purchased. 100 shares x 160 current market valueshare 16000. On the date of exercise the fair market value of the stock was 25 per share which is.

The Stock Option Plan specifies the employees or class of employees eligible to receive options. Lets say you got a grant price of 20 per share but when you exercise your.

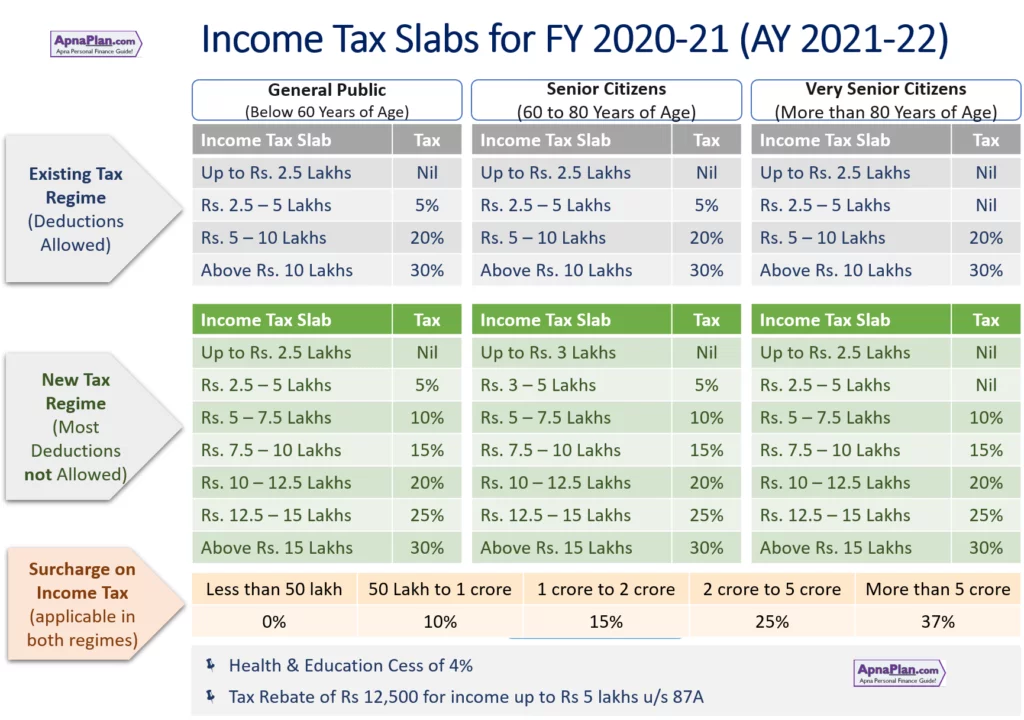

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Corporate Tax Calculator Template Excel Templates Excel Templates Business Tax Business Structure

Australia Crypto Tax Guide 2022 Koinly

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

How Stock Options Are Taxed Carta

Ltcg Tax Calculation Examples How It Is Done Groww

12 Ways To Find More Money To Invest In Your Biz Investing Small Business Finance Business Tax

Income Tax Calculator 2020 21 Calculate Taxes For Fy 2020 21 Income Tax Slabs 2020 21

How Stock Options Are Taxed Carta

Long Term Capital Gain Tax Calculator In Excel Financial Control

Capital Gains Tax Calculator For Relative Value Investing

How To Calculate Cannabis Taxes At Your Dispensary

Long Term Capital Gain Tax Calculator In Excel Financial Control

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

Capital Gains Tax Calculator For Relative Value Investing

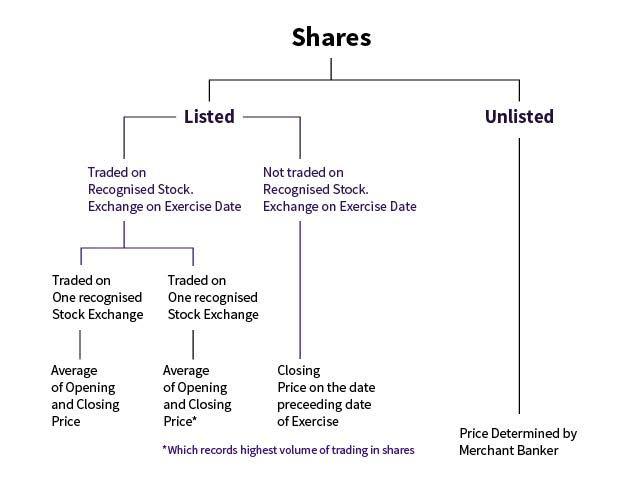

Getting Esop As Salary Package Know About Esop Taxation